About this deal

Providing the lenders with earning assets so as to enable them to earn wealth by deploying the assets in production debentures. Municipalities and local authorities may borrow in their own name as well as receiving funding from national governments. In the UK, this would cover an authority like Hampshire County Council. However, the extent to which this shift occurs will depend on a number of factors — including the ability of young economies to realize their demographic advantages, and the adaptability of aging economies to cope with their declining working-age populations.

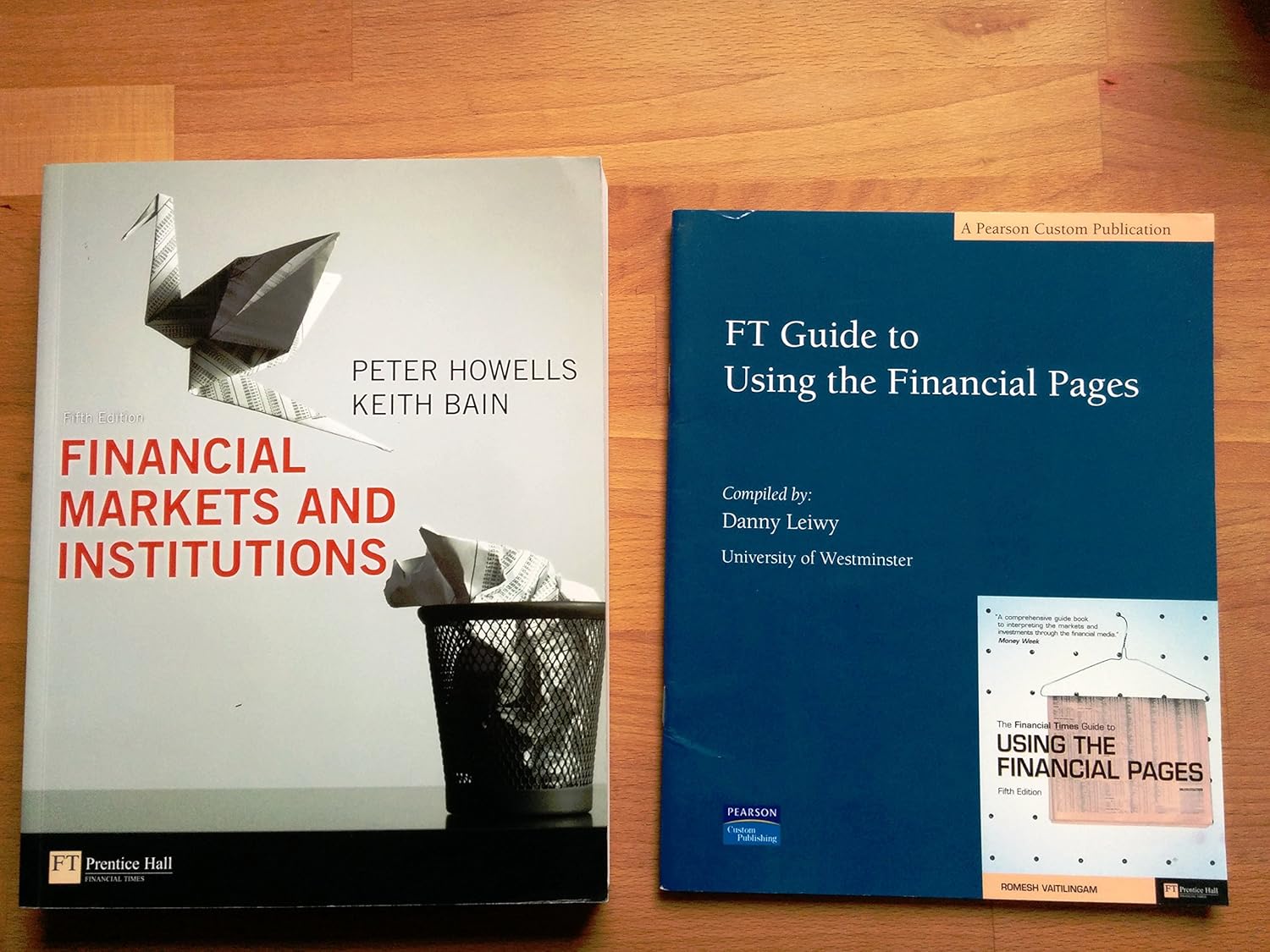

Financial Markets and Institutions, 10th edition | eTextBook Financial Markets and Institutions, 10th edition | eTextBook

Financial markets exist in virtually every country in the world. While some are very small, with just a small number of participants, others are gigantic – like the Forex markets – and trade trillions of dollars each day. Some financial markets are very discerning, like exclusive clubs, and only allow participants with a minimum amount of money, knowledge of markets,, or from certain professions. Merton, Robert C. (1992). Continuous-Time Finance. Macroeconomics and Finance Series. Wiley. ISBN 978-0-631-18508-6. LCCN gb92034883. The capital markets may also be divided into primary markets and secondary markets. Newly formed (issued) securities are bought or sold in primary markets, such as during initial public offerings. Secondary markets allow investors to buy and sell existing securities. The transactions in primary markets exist between issuers and investors, while secondary market transactions exist among investors. The IMF is adapting and strengthening its economic analysis of countries. To keep up with the pace of change, the IMF is modernizing surveillance to help policymakers better prepare for a transforming economic landscape. This year’s Comprehensive Surveillance Review is a good example of that trend.Let me highlight three aspects of this trend — all of which are making the innovation brought by digital money transformative: These financial markets serve different purposes and cater to various investment needs and risk profiles. They collectively contribute to the overall functioning and efficiency of the global financial system. All these continuing trends will interact in profound ways — and they will need careful management. The fact that these trends are happening at the same time — and that they will interact and influence each other—makes sound management and good governance all the more important.

Review: Financial Markets and Institutions | CFA Book Review: Financial Markets and Institutions | CFA

For his eighth and final question, Daniel suggests that we explore some of the implications of all of these trends for the people who are here in this audience today: treasury managers. What will all this mean for the future of debt, financial markets, currencies, and risk management? Information: The activities of the participants in the financial market result in the generation and the consequent dissemination of information to the various segments of the market. So as to reduce the cost of transaction of financial assets. Understanding Derivatives: Markets and Infrastructure - Federal Reserve Bank of Chicago". chicagofed.org . Retrieved 2017-12-12. The key areas of the syllabus examined are that of the role and functioning of the domestic and global financial system, the role of the non-deposit financial institutions such as investment trusts, unit trusts, the insurance industry and pension funds; as well as introduces students to the role and functioning of the markets within which the financial institutions/intermediaries operate, such as the money market, the bond market, the Eurocurrency markets, the equity market and the markets for derivative instruments. Finally, the module concludes with the examination of prior global and domestic financial crises.Crises and Regulation; recent financial crisis, historical perspectives, attempts at regulatory reform It is crucial that Emerging Markets put in place the right mix of fiscal, monetary and structural policies to secure a reliable local funding channel to finance the recovery. Williams, John C. "The Rediscovery of Financial Market Imperfections." Toward a Just Society: Joseph Stiglitz and Twenty-First Century Economics, edited by Martin Guzman, Columbia University Press, 2018, pp.201–06, JSTOR 10.7312/guzm18672.14.

Financial Markets and Institutions - De Montfort University Financial Markets and Institutions - De Montfort University

Even more important: Policymakers, standard-setters, financial institutions and non-financial private-sector firms must work together on the development of “green finance.” demonstrate ability to synthesise and use information and materials from a variety of different sources to support an argument. Understanding financial markets is crucial as it relates to the Indian economy, monetary policies, regulatory frameworks, and various financial instruments. It enables aspirants to analyze economic trends, evaluate policy decisions, and comprehend the functioning of the financial sector, which are relevant for UPSC exams assessing candidates’ knowledge of national and international issues. More generally, there may be a shift of credit intermediation away from banks and toward non-deposit taking institutions. It’s possible that we may see a shift in value-added from commercial banks to Big Techs, due to their competitive advantage in gathering and analyzing data.Abolafia, Mitchel Y. "A Learning Moment?: January 2008." Stewards of the Market: How the Federal Reserve Made Sense of the Financial Crisis, Harvard University Press, 2020, pp.49–70, doi: 10.2307/j.ctvx8b796.6. IRDA is the regulatory body for the insurance sector in India. It oversees the licensing, product approvals, and functioning of insurance companies, ensuring consumer protection and the soundness of the insurance industry. BAKLANOVA, VIKTORIA, and JOSEPH TANEGA. "MONEY MARKET FUNDS AFTER THE ONSET OF THE CRISIS." After the Crash: Financial Crises and Regulatory Responses, edited by Sharyn O’Halloran and Thomas Groll, Columbia University Press, 2019, pp.341–59, JSTOR 10.7312/ohal19284.25. In my department at the IMF — focusing on Monetary and Capital Markets: We focus a great deal of attention on the new wave of technological innovation — often called “fintech.” How fintech will accelerate changes in the financial sector, is a factor that will have profound implications for the world economy.

Related:

Great Deal

Great Deal